The Alphabet Soup exercise was posted here earlier as a general exercise to flesh out the impact of cognitive traps when applying frameworks. This focuses students to think about how frameworks, while valuable, could lead them astray as they try to analyze complex problems. A special application of this lesson is in the discussion of the problem of Architectural Innovation (see Henderson and Clark, ASQ 1990). That is, when firms are very familiar with a set of components, a small change in how they interact may create a very difficult adaptation challenge. Here, the letters in the alphabet are the components and a simple priming tool gets people focused on how these components relate. This exercise is very easy to run and makes the point powerfully how such cognitive frames may prevent people from reaching obvious solutions.

The Alphabet Soup exercise was posted here earlier as a general exercise to flesh out the impact of cognitive traps when applying frameworks. This focuses students to think about how frameworks, while valuable, could lead them astray as they try to analyze complex problems. A special application of this lesson is in the discussion of the problem of Architectural Innovation (see Henderson and Clark, ASQ 1990). That is, when firms are very familiar with a set of components, a small change in how they interact may create a very difficult adaptation challenge. Here, the letters in the alphabet are the components and a simple priming tool gets people focused on how these components relate. This exercise is very easy to run and makes the point powerfully how such cognitive frames may prevent people from reaching obvious solutions.

Netflix Sequel: Bidding Wars the Movie

As Netflix’s strategy unfolds it becomes clearer the extent to which it threatens traditional media companies. Initially, Netflix was a welcome partner who paid for access to older entertainment assets – new income streams for studios. More recently they have developed new content and lure top talent away from traditional media companies. Now, by offering a compelling portfolio of options, they compete more directly against traditional media companies. AT&T, Comcast, Fox, and Disney have taken notice of Netflix’s increasingly vertically integrated business model that bypasses traditional distributors (cable, DSL, satellite) and doesn’t rely on advertising revenue. The new model is driving mega mergers & bidding wars as rivals try to build compelling portfolios to offer streaming services. This is a great live case to frame many strategic management course topics including:

As Netflix’s strategy unfolds it becomes clearer the extent to which it threatens traditional media companies. Initially, Netflix was a welcome partner who paid for access to older entertainment assets – new income streams for studios. More recently they have developed new content and lure top talent away from traditional media companies. Now, by offering a compelling portfolio of options, they compete more directly against traditional media companies. AT&T, Comcast, Fox, and Disney have taken notice of Netflix’s increasingly vertically integrated business model that bypasses traditional distributors (cable, DSL, satellite) and doesn’t rely on advertising revenue. The new model is driving mega mergers & bidding wars as rivals try to build compelling portfolios to offer streaming services. This is a great live case to frame many strategic management course topics including:

- What is strategy? I use the Strategy Diamond and Netflix is a great case to look at things like staging and pacing, vehicles, and arenas.

- Market structure – How attractive is the media industry and how has this streaming model affected industry profitability

- Resources/Capabilities – Rivals lack some resources and some of their substantial existing resources have become “core rigidities” that hinder adaptation

- Competitive dynamics – What strategic moves can we observe? How will Netflix respond?

- Disruptive innovation – Netflix started as a limited low-cost alternative but added features that eventually made it a significant threat to incumbents.

- Corporate strategy – The billions rivals spent on M&A are another critical angle. This also provides a vehicle to discuss when vertical integration creates value.

I have assembled some useful materials to frame a discussion of this case. First, the case can be taught using a series of recent news articles (sample article pack). In addition, I have prepared a spreadsheet to explore scenarios for how various events might affect the value of Netflix. For instance, what would happen to its business model if the market started to value the company as a traditional media company as opposed to a tech firm? Similarly, what will happen if rivals’ M&A strategies succeed and pose a critical challenge? Finally, here is a link to a sample pre-class survey to help students think about the strategic issues before class.

Contributed by Russ Coff

A Classy Way to Participate

Class participation is typically a major component of grades in strategy courses. Some students are quite comfortable participating. Others not so much. This video from Rich Makadok offers some advice and instruction for students on how to do well on this portion of the class (you can find the script for the video here). This is designed especially to help those who have language barriers or who are otherwise uncomfortable speaking in class. Students learn how they can contribute to making the class better for everyone — including themselves. You may want to use the video in conjunction with class discussion voting arrows to help bring different perspectives to the forefront.

Class participation is typically a major component of grades in strategy courses. Some students are quite comfortable participating. Others not so much. This video from Rich Makadok offers some advice and instruction for students on how to do well on this portion of the class (you can find the script for the video here). This is designed especially to help those who have language barriers or who are otherwise uncomfortable speaking in class. Students learn how they can contribute to making the class better for everyone — including themselves. You may want to use the video in conjunction with class discussion voting arrows to help bring different perspectives to the forefront.

Contributed by Rich Makadok

Small Change in the Classroom

Strategy classes often give short shrift to managing change but this is where the rubber hits the road. Chris Smith offers a number of very simple group exercises that allow a deeper dive. These are especially helpful since they demonstrate key points quickly but in an interactive way. Of course, there are many other change management materials in the toolbox. One of my favorites is the classroom ruse. Here are a few that jumped out at me from Smith’s page:

Strategy classes often give short shrift to managing change but this is where the rubber hits the road. Chris Smith offers a number of very simple group exercises that allow a deeper dive. These are especially helpful since they demonstrate key points quickly but in an interactive way. Of course, there are many other change management materials in the toolbox. One of my favorites is the classroom ruse. Here are a few that jumped out at me from Smith’s page:

Small Change: Cross Your Arms. Ask students to cross their arms. When they are comfortable, ask them to cross their arms the other way. Ask why the 2nd attempt might have left them feeling uncomfortable, even though it’s basically the same action. How tricky is it to cross your arms in different ways and equally how tricky it is to cope with even very small changes? Steer the conversation towards specific changes within the university or in their experience with other organizations. Discuss how to deal with such discomfort.

Mindful Routines: Alien at Dinner. Ask students to imagine themselves as aliens observing a human dinner party. Their task is to point out unusual human social norms and to explain them to the beings on their imaginary planet. Why do they drink poisonous alcohol? Why do they knock their glasses together when celebrating? This exercise helps to point out that just because something is accepted, does not mean it is the best way of doing things. It prompts students to examine existing routines anew and assess whether there are better methods. Continue reading

Will a Robot Take Your Job?

Some fear that eventually and robots will be able to do anything that humans can — better. Many have hailed the dangers of artificial intelligence to society (see Stephan Hawking, Elon Musk, Bill Gates, etc.). Hundreds of millions of jobs would be affected. Trillions of dollars of wealth created (and captured by whom?). These are the potential impacts of a coming wave of automation. In this episode of Moving Upstream (below), the Wall Street Journal traveled to Asia to see the next generation of industrial robots, what they’re capable of, and whether they’re friend or foe to low-skilled workers. Interestingly, new innovations in robotics allow robots to work safely side-by-side with humans and this achieves higher levels of productivity than either humans alone or robots alone. This is because most processes are not 100% programmable and working side-by-side allows for greater flexibility in handling exceptions to programmed routines. This is a great video to discuss topics like technological innovation, substitution of capital for labor, and interfaces between humans and technology.

Some fear that eventually and robots will be able to do anything that humans can — better. Many have hailed the dangers of artificial intelligence to society (see Stephan Hawking, Elon Musk, Bill Gates, etc.). Hundreds of millions of jobs would be affected. Trillions of dollars of wealth created (and captured by whom?). These are the potential impacts of a coming wave of automation. In this episode of Moving Upstream (below), the Wall Street Journal traveled to Asia to see the next generation of industrial robots, what they’re capable of, and whether they’re friend or foe to low-skilled workers. Interestingly, new innovations in robotics allow robots to work safely side-by-side with humans and this achieves higher levels of productivity than either humans alone or robots alone. This is because most processes are not 100% programmable and working side-by-side allows for greater flexibility in handling exceptions to programmed routines. This is a great video to discuss topics like technological innovation, substitution of capital for labor, and interfaces between humans and technology.

Heard through Nicolai Foss

How Shipping Stays Afloat

As the container shipping industry continues to boom, companies are adopting new technologies to move cargo faster and shifting to crewless ships. But it’s not all been smooth sailing and the future will see fewer players stay above water. This WSJ video takes students through the history and shows how the industry structure has changed with new innovations. Excellent for teaching industry analysis and innovation (architectural/systemic innovation).

Heard through Nicolai Foss

Exercise: Building a Strategy

Generic strategies are easy enough to explain and students typically feel that they understand. But do they really? Could they develop and implement a sound strategy? Sometimes it’s worth a bit of additional hands-on experience to make sure the lessons stick. Probably the most important message is alignment — the need to design the organization and product to fit the strategy. In other words, to make the appropriate tradeoffs. Lee Bolman offers a very simple house building exercise (out of index cards) that makes these points very nicely. Teams plan what kind of houses they will build and organize their production. Strategies naturally fall into more low cost (simple one story house) or differentiation (complex two story). The 20% quality bonus and 20% first mover bonus help to highlight these competing objectives. This one-page handout describes the rules and process for running the exercise. The debrief focuses on the teams’ strategies and how they organized:

Generic strategies are easy enough to explain and students typically feel that they understand. But do they really? Could they develop and implement a sound strategy? Sometimes it’s worth a bit of additional hands-on experience to make sure the lessons stick. Probably the most important message is alignment — the need to design the organization and product to fit the strategy. In other words, to make the appropriate tradeoffs. Lee Bolman offers a very simple house building exercise (out of index cards) that makes these points very nicely. Teams plan what kind of houses they will build and organize their production. Strategies naturally fall into more low cost (simple one story house) or differentiation (complex two story). The 20% quality bonus and 20% first mover bonus help to highlight these competing objectives. This one-page handout describes the rules and process for running the exercise. The debrief focuses on the teams’ strategies and how they organized:

- Planning process — How did they frame the problem and explore solutions?

- Competitive Dynamics — A strategy is more likely to be successful if few firms (teams) adopt it. How do they anticipate what rivals will do?

- Implementation — Plans often don’t unfold as expected. A common problem is that when the time is up, they are stuck with inventories of unfinished products.

Overall, this is a simple and easy to implement exercise that drives home basic strategy and organization issues nicely. The exercise can be run in a little as 75 minutes, though 90 to 120 minutes provides more time for both the exercise and debriefing. The steps to run the exercise are:

- Provide materials to teams (2 packs of 3-5 cards, 2-3 rolls of tape, 2-3 markers).

- Distribute the Quality Housing Instructions. Briefly introduce the exercise and announce how much time is available for planning (10 min). At the end of the production period, do a count-down from 5 and firmly announce “Stop!”. Teams may be startled when the time is up.

- Once teams have produced, have them calculate their expenses, revenue, and net income. You can check houses against the specifications either immediately after a team produces, or after all teams have produced. If a team produces multiple houses, test a few to see if they can be dropped 12 inches without damage.

- Collect the financial results from all teams (revenue, costs, net), and award the bonuses for quality and first-to-market.

Contributed by Lee Bolman

Print the Legend: A multidimensional case

Print the Legend (2014) is a documentary about the 3-D printing industry, that offers an engaging case study covering industry, firm & technology life cycles, disruptive technologies, and strategy in emerging firms & industries. This industry was established in the 1980s focusing on large expensive printers for industrial use – Two key players dominated using different technologies. The market was seriously shaken by startups in the 2010s that drastically reduced pricing created a consumer market. As such, we see two distinct market segments (industrial & consumer) and two technologies (stereolithography & fused-deposition) all battling it out.

The film follows two startups from emergence through VC funding, and shows their diverging paths as one is acquired and one remains independent. MakerBot, hires an experienced Strategy Director who (with the VC) radically shifts the founding strategy. This leads to high turnover and eventually, founder exit and acquisition by a leading industrial 3-D printing incumbent. In contrast, FormLabs, takes a more emergent approach to strategizing and positioning. The award-winning film is very well-made and fun to watch – Students love it and learn from it. It features a prominent VC (Brad Feld) and startups that students may be aware of.

Teaching notes: The film (available on Netflix) runs 100 minutes, so with discussion, it takes a full 3-hour class. It is helpful toward the end of the semester as a “movie day” with popcorn and snacks – students appreciate a break the week before their big final project is due. It is helpful to spend about 20 minutes at the start of class giving a mini-lecture on firm & industry life cycles and disruptive technologies, to set up the film, as well as about 10 minutes at the end for a debrief. One can show the film in 10-20 minute segments, pausing to discuss what has happened so far. This case has been a big hit over the 2 years it has been in use. It’s a little logistically complex, and requires strict adherence to a schedule, but once you have it down, it’s a very easy class and case to teach. Full teaching notes, assigned pre-reading, slides, and film segments are available on Gina’s shared teaching site.

Contributed by Gina Dokko

Diversification & Expansion: Stovetop Thanksgiving Pants

Often in a strategy course, one hits the topic of diversification toward the end of the semester — right when people are most focused on expansion. Diversification may reflect a recognition of opportunities that arise from problems or challenges that the firm’s core customers face. Then the firm can serve the same customers in multiple ways by entering new business segments. In this way, Stovetop Stuffing recognizes that their customers have common needs (for expansion) around the time of Thanksgiving and this video shows how diversification can help them meet those needs. Note the synergies in that customers are able to consume more of the firm’s core product…

Contributed by Rick Marolt

Free Money … No Takers?

Entrepreneurship students often think they’ve found a “no brainer” idea – one that everyone “obviously” will want. We’ve all seen it before – an idea that is so good that it requires zero dollars for customer acquisition because word of mouth and social media will lead to infinite sales, virtually overnight.

Entrepreneurship students often think they’ve found a “no brainer” idea – one that everyone “obviously” will want. We’ve all seen it before – an idea that is so good that it requires zero dollars for customer acquisition because word of mouth and social media will lead to infinite sales, virtually overnight.

Here’s an exercise that may help open students eyes to just how hard it can be to sell something. Even something as wonderful as their idea. Give each student group five single dollar bills. Ask them to develop a plan for giving away the dollar bills to strangers, in a public place. Have them develop a business plan that includes a target audience, script, etc. Giving away free money is harder than it appears! And if it’s hard to give away dollar bills, it will also be hard to get the attention of customers even for a “no brainer” idea. This exercise comes from the following video which might be assigned after the exercise as part of the debriefing.

Contributed by Susan Cohen

Tom Petty & the Perils of Strategic Alliances

Strategic Alliances don’t make the news the way M&A do so some may struggle for examples. It is especially helpful to make students aware that, while Alliances may be less risky than M&A, there are still risks that need to be analyzed. Tom Petty provided a useful example to apply the “Four C” alliance framework. Like many musicians, he signed a contract with a record label before he made it. He and ABC had Complementary capabilities needed to develop and promote hits. Initially, they had Congruent Goals in that their interests were aligned to make the band a hit. Organizationally, they were Compatible in that they were able to coordinate effectively. What Petty failed to anticipate was how things would Change over the course of their agreement. By their 3rd album, he felt that the arrangement was so unfair that he tried to back out of the agreement claiming that ABC had no right to sell the contract to MCA. Ultimately, he only got out of it by declaring bankruptcy. The song, Refugee captures the anger he felt over how he was treated by the record companies and offers a nice lead in to the discussion. This also brings out a discussion of bargaining power and how it may change over time.

Strategic Alliances don’t make the news the way M&A do so some may struggle for examples. It is especially helpful to make students aware that, while Alliances may be less risky than M&A, there are still risks that need to be analyzed. Tom Petty provided a useful example to apply the “Four C” alliance framework. Like many musicians, he signed a contract with a record label before he made it. He and ABC had Complementary capabilities needed to develop and promote hits. Initially, they had Congruent Goals in that their interests were aligned to make the band a hit. Organizationally, they were Compatible in that they were able to coordinate effectively. What Petty failed to anticipate was how things would Change over the course of their agreement. By their 3rd album, he felt that the arrangement was so unfair that he tried to back out of the agreement claiming that ABC had no right to sell the contract to MCA. Ultimately, he only got out of it by declaring bankruptcy. The song, Refugee captures the anger he felt over how he was treated by the record companies and offers a nice lead in to the discussion. This also brings out a discussion of bargaining power and how it may change over time.

Contributed by Russ Coff

Jeopardy 2017: Updated Course Closer

What is the best way to close out a course? The current gamification trend suggests updating some tried and true methods. Below is a classic Toolbox post on how to turn the last day into a game of Jeopardy. However, MBA students at the University of South Florida have recently updated it with a very slick PowerPoint version that is really worth checking out. Since the file has macros, you will need to download it and run it in PowerPoint (can’t be viewed otherwise). The categories and questions can be edited in PowerPoint. The students read Richard Rumelt’s Good Strategy, Bad Strategy and turned the key points into Jeopardy questions. They then used buzzers (below) and the file above to run a Jeopardy-based class exercise. (Thanks so much to Erwin Danneels and his students, Pranali Panjwani, Elliott Parker, Blesson Mullappally, Saharsh Kislaya, Bikash Patra, for sharing).

What is the best way to close out a course? The current gamification trend suggests updating some tried and true methods. Below is a classic Toolbox post on how to turn the last day into a game of Jeopardy. However, MBA students at the University of South Florida have recently updated it with a very slick PowerPoint version that is really worth checking out. Since the file has macros, you will need to download it and run it in PowerPoint (can’t be viewed otherwise). The categories and questions can be edited in PowerPoint. The students read Richard Rumelt’s Good Strategy, Bad Strategy and turned the key points into Jeopardy questions. They then used buzzers (below) and the file above to run a Jeopardy-based class exercise. (Thanks so much to Erwin Danneels and his students, Pranali Panjwani, Elliott Parker, Blesson Mullappally, Saharsh Kislaya, Bikash Patra, for sharing).

If you want to add some spice to this exercise, you might get a set of buzzers that contestants can use to get control of the board. Here is a link for a reasonably priced set of buzzers on Amazon.

If you want to add some spice to this exercise, you might get a set of buzzers that contestants can use to get control of the board. Here is a link for a reasonably priced set of buzzers on Amazon.

This can also be done in a lower tech manner by using a white board for the categories and dollar amounts. One can also have Daily Doubles and a final Jeopardy question. The ‘prize’ might be that the winning team gets extra class participation points for that day. Alternatively, one might find other meaningful prizes to distribute.

Here is another take at Jeopardy Questions in a word file. As you can see, they are a mix of course ideas and fun topics. For the category ‘Before and After’ (which is the hardest), the instructor would display the question on a projector so students could read and think about it (otherwise one can just read the questions).

Submarines, Electric Cars and Corporate Scope

It’s been a red letter week in terms of the business combination scavenger hunt. In addition to Dyson entering electric cars, now we see Aston Martin going into the submarine business. These are both serious ventures. Dyson has had 400 staff members working on this project for over two years and expects to bring a product to market in 2020. One can’t resist wondering if it will really suck (I know, vacuum humor isn’t in vogue — if it ever was)…

It’s been a red letter week in terms of the business combination scavenger hunt. In addition to Dyson entering electric cars, now we see Aston Martin going into the submarine business. These are both serious ventures. Dyson has had 400 staff members working on this project for over two years and expects to bring a product to market in 2020. One can’t resist wondering if it will really suck (I know, vacuum humor isn’t in vogue — if it ever was)…

More seriously, Dyson is a private company and so won’t face as much market pressure to explain why/how the business portfolio creates value. Also, while most of us are more familiar with their vacuum business, they are a diversified manufacturing company. This includes supplying inputs for the automobile industry among others. One might argue that they have more complementary assets to produce electric cars than Tesla had when they first started. But still…

Aston Martin’s effort is also serious. It’s worth noting that, unlike Dyson, they plan to do this with a partner, Triton Submarines, that is already a player in the luxury submarine market.

Drawing on the Strategy Diamond framework, a vehicle is the mode used to acquire resources needed to enter a new market. In this context, why would Dyson use organic growth to enter electric cars while Aston Martin forms a strategic alliance to enter submarines? In each case, the firm lacks important resources needed to enter. One might apply Capron & Mitchell’s Resource Pathway’s Framework. This could lead one to conclude that Dyson is overestimating the relevance of its internal resources (to go without a partner). In the case of Aston Martin, since their partner has all the capabilities needed to produce the product, the main asset that Aston Martin brings is their brand. This may be useful to court customers who are James Bond fans — Perhaps not the largest market segment among those seeking submarines.

Meanwhile, Ikea just acquired TaskRabbit — presumably a bid to vertically integrate into assembling the furniture they sell in kits.

These efforts do not necessarily restore one’s confidence in managers’ abilities to make reasoned decisions about the scope of the firm.

Contributed by Russ Coff

Does the Term “Core Competence” Destroy Value?

The term “core competence” has taken hold in the business world. Not many academic terms break through to common usage so this might be viewed as a tremendous success. Unfortunately, it isn’t clear that it is particularly useful with the modified practitioner definition. As it is commonly used, it seems to mean “stuff the firm is pretty good at.” Unlike Prahalad and Hamel’s original article, common usage does not suggest that these capabilities: necessarily confer value in the eyes of customers over what rivals can produce, are hard to imitate, or that they are especially relevant in a corporate (multi-business) context.

The term “core competence” has taken hold in the business world. Not many academic terms break through to common usage so this might be viewed as a tremendous success. Unfortunately, it isn’t clear that it is particularly useful with the modified practitioner definition. As it is commonly used, it seems to mean “stuff the firm is pretty good at.” Unlike Prahalad and Hamel’s original article, common usage does not suggest that these capabilities: necessarily confer value in the eyes of customers over what rivals can produce, are hard to imitate, or that they are especially relevant in a corporate (multi-business) context.

Stripped of these defining characteristics, is the term useful?

As it is commonly used, the term can help firms distinguish what they are relatively good at from things that they are not. This is akin to a simple business unit-level internal analysis that identifies strengths and weaknesses. While it is important for firms to be aware of their strengths and weaknesses, by not comparing the strengths to rivals, we cannot infer whether the firm has a competitive advantage or how long such an advantage might last. It could even reflect a competitive disadvantage if rivals are superior in those areas. As a mode of internal analysis, the common usage doesn’t really go beyond SWOT analysis, which itself is woefully inadequate as a form of analysis.

When practitioners use the term core competence, it is often preceded by the words “stick to your…” That is, the firm should understand what they are good at and avoid straying from strengths. Of course, acquiring a new competence should be an important strategic decision – not to be taken lightly. However, the traditional advice seems to miss the mark if it implies that firms should avoid such decisions altogether. Classic examples of railroads, radio broadcasting, or, more recently, Toys ‘R’ Us illustrate how sticking to one’s knitting is not always the best strategy.

In short, as an internal analysis tool, the common usage of the term core competence does not add much value – certainly not relative to other internal analysis tools like value chain and VRIO analysis.

How do multi-business firms create value? Continue reading

Get Out the Vote … In Class

When leading a case discussion, wouldn’t it be nice to know exactly what positions students were prepared to defend? You want to bring people into the conversation who you know will have diverse perspectives to bring about a balanced discussion. Idie Kesner has a great low tech solution to your problem. Create arrow tents that can be reversed so they can display either up or down arrows (see the picture to the right). You can see instantly who is in favor or opposed to the strategic move proposed in a case. The instructor can call on people with an idea of what perspective they will bring in and/or encourage debate between students who have different positions. Here is a a template for the Student Voting Arrows (2 arrows/page).

When leading a case discussion, wouldn’t it be nice to know exactly what positions students were prepared to defend? You want to bring people into the conversation who you know will have diverse perspectives to bring about a balanced discussion. Idie Kesner has a great low tech solution to your problem. Create arrow tents that can be reversed so they can display either up or down arrows (see the picture to the right). You can see instantly who is in favor or opposed to the strategic move proposed in a case. The instructor can call on people with an idea of what perspective they will bring in and/or encourage debate between students who have different positions. Here is a a template for the Student Voting Arrows (2 arrows/page).

A related innovation is tents that display the letters A through D. This can be used for cases that offer up to 5 alternatives that students might vote for (a,b,c,d, and no tent). Here is a template for the “a through d” student voting table tent. This must be folded lengthwise first to select the appropriate letter and then widthwise so the letter is displayed as a table tent (visible from both sides).

A related innovation is tents that display the letters A through D. This can be used for cases that offer up to 5 alternatives that students might vote for (a,b,c,d, and no tent). Here is a template for the “a through d” student voting table tent. This must be folded lengthwise first to select the appropriate letter and then widthwise so the letter is displayed as a table tent (visible from both sides).

Contributed by Idie Kesner

Amazon Eats Whole Foods

With its $13.7B bid, Amazon agreed to pay a 27% premium over Whole Foods’ previous market valuation. This makes for a nice live case case in your strategy classroom. Was this a sound business decision? The market rewarded Amazon with an increase in its stock price. While some opportunities are apparent, it remains unclear exactly how Whole Foods will be worth 27% more to Amazon (and that’s just to break even). A five forces analysis will reveal that the grocery market is highly competitive with exceptionally thin margins — not an especially attractive industry to enter. So how can they win in this game? There are many possibilities that may come up in a discussion. For example, Amazon may:

With its $13.7B bid, Amazon agreed to pay a 27% premium over Whole Foods’ previous market valuation. This makes for a nice live case case in your strategy classroom. Was this a sound business decision? The market rewarded Amazon with an increase in its stock price. While some opportunities are apparent, it remains unclear exactly how Whole Foods will be worth 27% more to Amazon (and that’s just to break even). A five forces analysis will reveal that the grocery market is highly competitive with exceptionally thin margins — not an especially attractive industry to enter. So how can they win in this game? There are many possibilities that may come up in a discussion. For example, Amazon may:

- Build online grocery sales, a tiny but growing portion of the industry.

- Lower costs by applying automation technology and their supply chain expertise.

- Use customer data to build sales through Amazon or to sell some higher margin “impulse” items at Whole Foods.

- Leverage the market’s expectations that Amazon won’t pay dividends or post significant profit to lower prices and invest in the business.

Of course, these are highly speculative and carry significant risks. What is the likelihood that any of these will be achieved? Can Amazon manage change in such a large acquisition? Will other grocers make similar changes (or be bought out by tech companies with similar capabilities)? There is lots of fodder to discuss. Here is a packet of news articles that may be helpful. Also, I have prepared a spreadsheet to explore different scenarios for how this might play out where the starting point is Whole Foods’ recent financial performance (note that the decision tree requires the PrecisionTree Excel Add-in). Finally, here is a very brief poll to help assure that students come to class prepared and with an opinion on the deal.

Contributed by Russ Coff

Deflategate: Letting the air out of strategic planning

Strategies rarely work out as planned but somehow, students remain eternally hopeful that everything will go exactly as they expect. This experiential exercise allows students to “feel” Mintzberg’s (1994) critique of strategic planning. It also helps to illustrate and compare causation and effectuation decision-making logics (e.g., finding entrepreneurial opportunities). You can bring “Deflategate” (from the 2015 NFL season) to a classroom near you. The exercise proceeds as follows:

Strategies rarely work out as planned but somehow, students remain eternally hopeful that everything will go exactly as they expect. This experiential exercise allows students to “feel” Mintzberg’s (1994) critique of strategic planning. It also helps to illustrate and compare causation and effectuation decision-making logics (e.g., finding entrepreneurial opportunities). You can bring “Deflategate” (from the 2015 NFL season) to a classroom near you. The exercise proceeds as follows:

Inflate ball & sit on it. Ask 2 volunteers to inflate a heavy duty inflatable ball using a small air pump (one can buy these a sport store) and try to sit on it afterwards for a minute. While introducing the exercise, the instructor should keep the plug hidden in her/his pocket. Inflating the ball is amusing (both the volunteers and the audience). It is not easy or quick to inflate the ball.

Inflate ball & sit on it. Ask 2 volunteers to inflate a heavy duty inflatable ball using a small air pump (one can buy these a sport store) and try to sit on it afterwards for a minute. While introducing the exercise, the instructor should keep the plug hidden in her/his pocket. Inflating the ball is amusing (both the volunteers and the audience). It is not easy or quick to inflate the ball.- Where’s the plug? After inflating, students look for a plug. The instructor waits a few seconds and

takes the plug out admitting that she/he had it all the time. The class will laugh. It may be frustrating for the volunteers but then we begin the debrief and explain the reason for the deception in the exercise.

takes the plug out admitting that she/he had it all the time. The class will laugh. It may be frustrating for the volunteers but then we begin the debrief and explain the reason for the deception in the exercise. - Debrief: According to Mintzberg, decision-makers (those who inflate the ball) expect everything will go smoothly according to what they planned but usually some unexpected circumstances occur that alter the plan’s effectiveness. Decision-makers cannot anticipate everything and the exercise drives this home and shifts focus to decision-makers’ bounded rationality. It is quite rare that students will look for a plug before doing the exercise (though it happens on occasion). One might move from here to discuss innovation, business models and disruptive innovation.

Other related toolbox exercises that demonstrate the challenge of predicting outcomes and implementing effectively include the Tinkertoy Exercise, the Strategy Puzzle, and the Paper fight. There are also some materials under the topic of scenario planning.

Contributed by Piotr WÓJCIK

Failure: The sequel

This is another in our series of explorations in learning from failure (and learning from success). The Swedish Museum of Failures reminds us of some of the most spectacular product failures. Interestingly, most of them can be closely linked to some spectacular product successes. A complete failure may be a near miss. Perhaps a slight pivot away from extreme success. This video offers a window into some of the more interesting exhibits in the museum. One might ask students to review the video and imagine how a well-placed pivot might have helped each failure turn the corner. This might also fit with some of the toolbox posts on pivoting.

This is another in our series of explorations in learning from failure (and learning from success). The Swedish Museum of Failures reminds us of some of the most spectacular product failures. Interestingly, most of them can be closely linked to some spectacular product successes. A complete failure may be a near miss. Perhaps a slight pivot away from extreme success. This video offers a window into some of the more interesting exhibits in the museum. One might ask students to review the video and imagine how a well-placed pivot might have helped each failure turn the corner. This might also fit with some of the toolbox posts on pivoting.

Contributed by Russ Coff

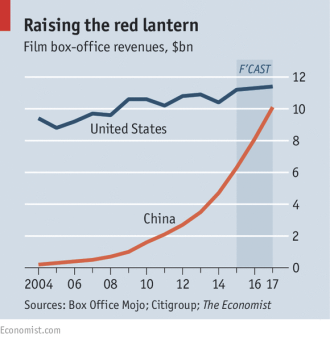

Hollywood Breaks Into China

How do firms modify their products so they will be well-received in the most promising global markets? Case in point: Hollywood’s biggest movies are being subtly reworked to appeal to Chinese audiences. Since, that market may soon outstrip the U.S. to become the most lucrative movie audience in the world (see chart). Movies like Warcraft and Now You See Me 2 have been huge successes in China even though their domestic performance has lagged. Why? The Warcraft cast features Daniel Wu, a very bright star in China, who may have been unrecognizable as the orc Gul’dan, but his promotional efforts were important to the film’s success. Similarly, Now You See Me director, Jon M. Chu, cast star Jay Chou and filmed a portion of the movie in the Chinese region of Macau. The movie industry is a great example of product design for market entry. The following video frames it nicely for students interested in addressing barriers to market entry.

How do firms modify their products so they will be well-received in the most promising global markets? Case in point: Hollywood’s biggest movies are being subtly reworked to appeal to Chinese audiences. Since, that market may soon outstrip the U.S. to become the most lucrative movie audience in the world (see chart). Movies like Warcraft and Now You See Me 2 have been huge successes in China even though their domestic performance has lagged. Why? The Warcraft cast features Daniel Wu, a very bright star in China, who may have been unrecognizable as the orc Gul’dan, but his promotional efforts were important to the film’s success. Similarly, Now You See Me director, Jon M. Chu, cast star Jay Chou and filmed a portion of the movie in the Chinese region of Macau. The movie industry is a great example of product design for market entry. The following video frames it nicely for students interested in addressing barriers to market entry.

Contributed by Russ Coff

Angry Shareholders Sacrifice Donkey

Shareholder activism is often identified as a mechanism to discipline managers and keep them focused on value creation for investors. An NPR story reports that shareholders in a zoo near Shanghai, frustrated that they weren’t making a profit on their investment, fed a live donkey to zoo tigers as a form of protest. At a shareholders meeting they voted in favor of feeding the donkey to the tigers to express their anger. Their objections center on the zoo’s debts and legal troubles. For two years, the investors said the venture has not been profitable. The video of the event has stoked public outrage and condemnation. While this is a rather unusual example of shareholder activism, it may spur some fruitful discussion in class. One of the interesting elements of this action is that the Corporate Social Responsibility literature would lead us to expect that investors have idiosyncratic preferences and will make trade-offs on returns (see this article by Mackey, Mackey & Barney). For example, one might expect that investors in a zoo would be willing to trade off financial returns to care for animals. A protest of poor profitability that hurts an animal seems especially unlikely. Yet there is is. As the cartoon implies, there are other ways for investors to protest…

Shareholder activism is often identified as a mechanism to discipline managers and keep them focused on value creation for investors. An NPR story reports that shareholders in a zoo near Shanghai, frustrated that they weren’t making a profit on their investment, fed a live donkey to zoo tigers as a form of protest. At a shareholders meeting they voted in favor of feeding the donkey to the tigers to express their anger. Their objections center on the zoo’s debts and legal troubles. For two years, the investors said the venture has not been profitable. The video of the event has stoked public outrage and condemnation. While this is a rather unusual example of shareholder activism, it may spur some fruitful discussion in class. One of the interesting elements of this action is that the Corporate Social Responsibility literature would lead us to expect that investors have idiosyncratic preferences and will make trade-offs on returns (see this article by Mackey, Mackey & Barney). For example, one might expect that investors in a zoo would be willing to trade off financial returns to care for animals. A protest of poor profitability that hurts an animal seems especially unlikely. Yet there is is. As the cartoon implies, there are other ways for investors to protest…

Contributed by Russ Coff