Alliances may be disrupted for reasons beyond partners’ control, ranging from pandemics to cyber attacks. They then look to the contract for a way forward. When obligations are not met, contracts focus attention on blame and penalties for the breach. Force majeure clauses may void a contract without penalties but they are typically applied narrowly, if at all (weather-related events, etc.). So, the parties must assess blame, assign penalties, and void the existing contract before finding a way forward even if a disruption could not have been anticipated or prevented. Economic recovery from the pandemic depends on many firms addressing this difficult challenge.

This negotiation exercise, conducted in a session at the SMS Milan conference, drives that point home. The context is a UK-based office equipment company (SmartTech) and their alliance with an Italian chip manufacturer (ChipComm). Italy was closed down by the pandemic while the UK remained open and the supplier was unable to meet obligations. The parties must determine if ChipComm is culpable and if so, what penalties apply. Then, they need to identify how they might revise the contract to move forward. Of course, building trust to move forward after assessing penalties is no easy task.

The exercise is straightforward in terms of the timing. We describe the setting and assign roles in class. Then they have 5 minutes to read the 2-page roles. We then pair them with someone who has the opposite role and give them 15 minutes to negotiate. They can then enter their contracts into a Google form which summarizes the contracts for class discussion. Here are the materials: SmartTech role, ChipComm role, Sample form for students to enter contracts.

This leads to a rich discussion of when contracts are harder to reboot (degree of trust, fairness/sharing losses, attribution of blame, contract language regarding penalties or bonuses, nature/extent of the disruption, etc.). For example, students may compare the pandemic context to a disruption caused by a less pervasive factor, such as a ransomware attack. Prior specific investments make both parties more committed to continuing the relationship – perhaps even if the specific assets are no longer needed. Then, the question is how to gain trust when the contract has failed, and who to involve in the process (lawyer cat may be less helpful here…).

Contributed by Libby Weber and Russ Coff

I like to start the semester with a “ripped from the headlines” case. This is especially helpful if some of one’s cases are older. This semester, Zoom is a great alternative. The current

I like to start the semester with a “ripped from the headlines” case. This is especially helpful if some of one’s cases are older. This semester, Zoom is a great alternative. The current  Firms often make errors in selecting governance forms and the scope of the firm. This is one common reason firms must undergo painful periodic restructuring programs. If only managers could frame these problems more effectively and identify the key factors to make more informed decisions — in short, a primer on Transaction Cost Economics (TCE). Brian Silverman provides just that tool in a

Firms often make errors in selecting governance forms and the scope of the firm. This is one common reason firms must undergo painful periodic restructuring programs. If only managers could frame these problems more effectively and identify the key factors to make more informed decisions — in short, a primer on Transaction Cost Economics (TCE). Brian Silverman provides just that tool in a  Much of the news focuses on how hard businesses have been hit by the pandemic. However, strategy is about finding opportunities and adapting in a dynamic environment. Let’s not forget to focus on inspirational examples along these lines. Send students on a scavenger hunt (like the

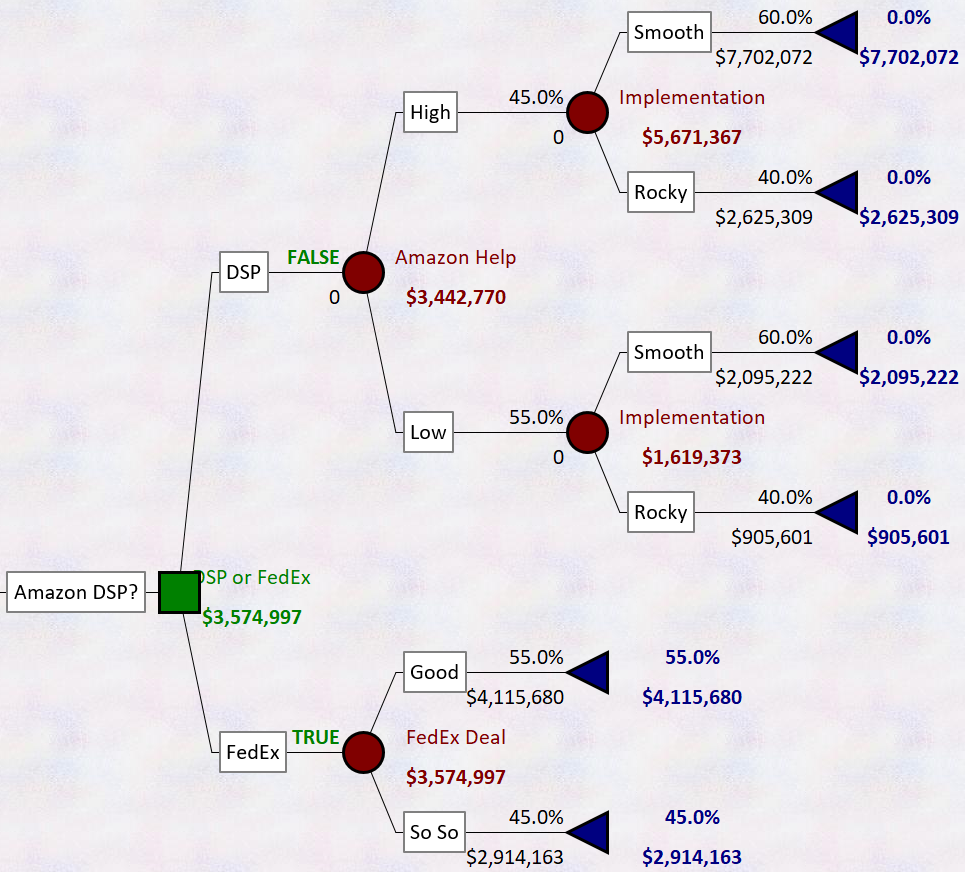

Much of the news focuses on how hard businesses have been hit by the pandemic. However, strategy is about finding opportunities and adapting in a dynamic environment. Let’s not forget to focus on inspirational examples along these lines. Send students on a scavenger hunt (like the  Amazon is encouraging employee spinouts. They are offering employees $10,000 plus 3 months salary to quit and form entrepreneurial ventures in their

Amazon is encouraging employee spinouts. They are offering employees $10,000 plus 3 months salary to quit and form entrepreneurial ventures in their  As Netflix’s strategy unfolds it becomes clearer the extent to which it threatens traditional media companies. Initially, Netflix was a welcome partner who paid for access to older entertainment assets – new income streams for studios. More recently they have developed new content and lure top talent away from traditional media companies. Now, by offering a compelling portfolio of options, they compete more directly against traditional media companies. AT&T, Comcast, Fox, and Disney have taken notice of Netflix’s increasingly vertically integrated business model that bypasses traditional distributors (cable, DSL, satellite) and doesn’t rely on advertising revenue.

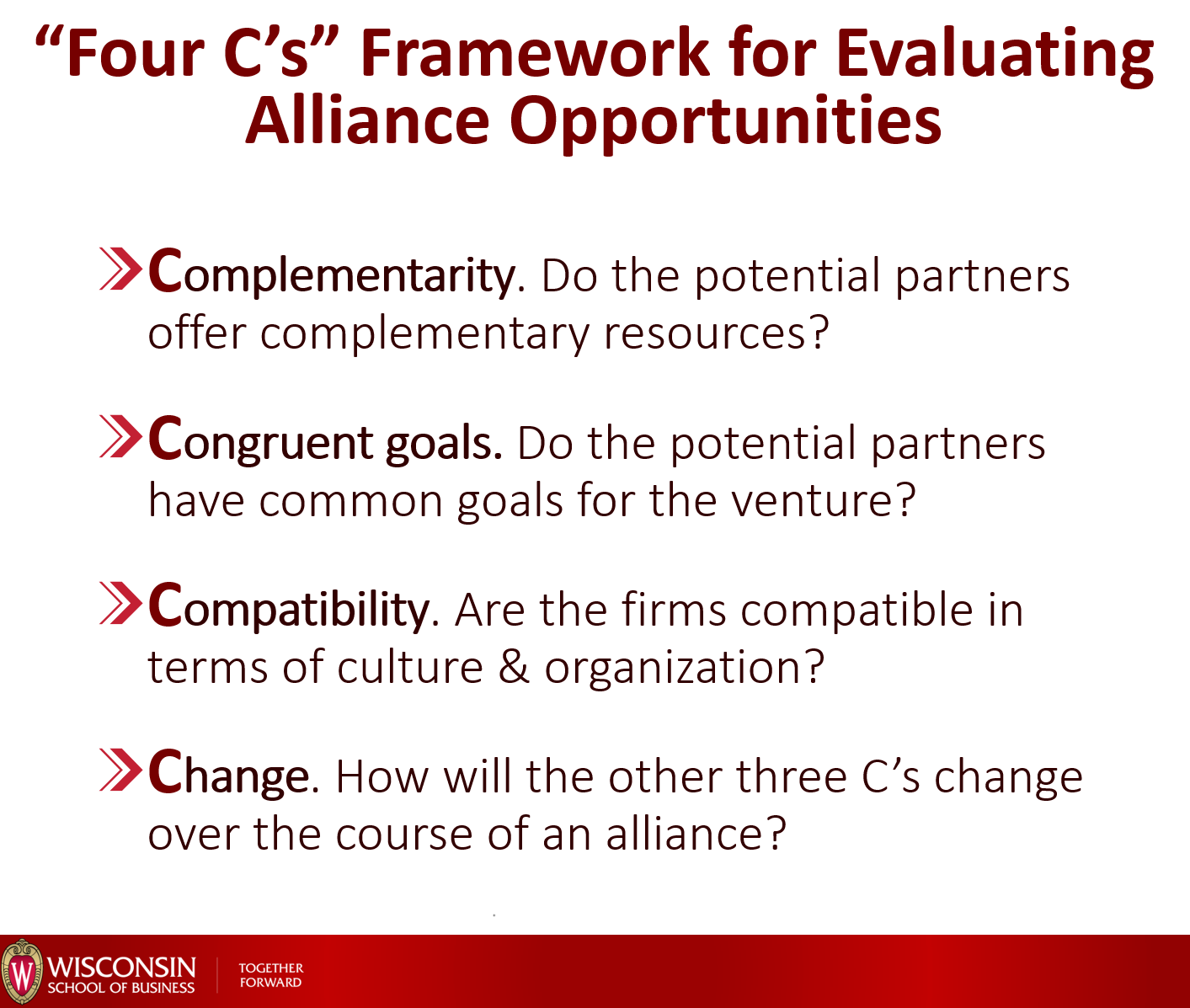

As Netflix’s strategy unfolds it becomes clearer the extent to which it threatens traditional media companies. Initially, Netflix was a welcome partner who paid for access to older entertainment assets – new income streams for studios. More recently they have developed new content and lure top talent away from traditional media companies. Now, by offering a compelling portfolio of options, they compete more directly against traditional media companies. AT&T, Comcast, Fox, and Disney have taken notice of Netflix’s increasingly vertically integrated business model that bypasses traditional distributors (cable, DSL, satellite) and doesn’t rely on advertising revenue.  Strategic Alliances don’t make the news the way M&A do so some may struggle for examples. It is especially helpful to make students aware that, while Alliances may be less risky than M&A, there are still risks that need to be analyzed. Tom Petty provided a useful example to apply the

Strategic Alliances don’t make the news the way M&A do so some may struggle for examples. It is especially helpful to make students aware that, while Alliances may be less risky than M&A, there are still risks that need to be analyzed. Tom Petty provided a useful example to apply the  It’s been a red letter week in terms of the

It’s been a red letter week in terms of the  This isn’t the first time polls have been wrong. The election of Donald Trump was a shock to many college students (as well as the press) and this may warrant some class time. Some instructors responded by

This isn’t the first time polls have been wrong. The election of Donald Trump was a shock to many college students (as well as the press) and this may warrant some class time. Some instructors responded by  The augmented reality (AR) game,

The augmented reality (AR) game,

Mattel just lost to Hasbro on producing Disney princess dolls — a $500M a year business. This brings to an end a 60+ year strategic alliance.

Mattel just lost to Hasbro on producing Disney princess dolls — a $500M a year business. This brings to an end a 60+ year strategic alliance.  hich would prefer that it be produced in the U.S. The car is produced through a joint venture with China’s largest auto maker SAIC Motor Corp. Rather than produce the car in the U.S., GM plans to import the Envision from Yantai, China, where the joint venture has produced the vehicle for about a year. Through the first 11 months of 2015 it sold 127,000 of them in China. This example brings out several key points with respect to strategic alliances. Certainly the UAW viewpoint brings in a stakeholder perspective. However, SAIC is also potentially a competitor. It’s home market has sheltered it while it gained capabilities to produce on a very large scale. Recently,

hich would prefer that it be produced in the U.S. The car is produced through a joint venture with China’s largest auto maker SAIC Motor Corp. Rather than produce the car in the U.S., GM plans to import the Envision from Yantai, China, where the joint venture has produced the vehicle for about a year. Through the first 11 months of 2015 it sold 127,000 of them in China. This example brings out several key points with respect to strategic alliances. Certainly the UAW viewpoint brings in a stakeholder perspective. However, SAIC is also potentially a competitor. It’s home market has sheltered it while it gained capabilities to produce on a very large scale. Recently,  Lego profits have more than doubled in the last five years. The company has sold non-core businesses and doubled down on the core building block products. They are the undisputed king of building toys. A

Lego profits have more than doubled in the last five years. The company has sold non-core businesses and doubled down on the core building block products. They are the undisputed king of building toys. A